Australian law firms face increasing pressure to balance profitability, growth, and client satisfaction. While strong legal expertise remains the cornerstone of success, firms that thrive over the long term also excel in financial management. Precise financial reporting is more than a compliance exercise, it is a strategic tool that empowers the leadership team in law firms to make informed decisions, allocate resources effectively, and chart a sustainable path forward.

Moving Beyond Compliance

Traditionally, many legal firms have viewed financial reporting as a periodic requirement to satisfy partners or tax obligations. However, this narrow perspective leaves significant value untapped. Accurate, timely, and detailed reports go far beyond compliance. They provide a clear picture of how the business operates, which practice areas deliver the greatest return, and where inefficiencies may be eroding profit margins.

For example, an income statement showing healthy overall revenue may conceal the fact that certain departments consistently underperform. Without granular reporting, law firm stakeholders might miss opportunities to realign resources toward more profitable services. Similarly, without accurate expense tracking, hidden costs, such as administrative overhead, technology investments, or underutilised staff can quietly diminish profitability.

In a recent article by Legal Compass, it was stated that “A comprehensive understanding of your firm’s revenue streams is the foundation of effective budgeting. Differentiate between various sources, such as retainer fees, contingency fees, and hourly billing, and analyse their predictability and volatility” (legalcompass.com.au, 2024).

Driving Profitability and Growth

Precise reporting supports strategic growth by highlighting the most lucrative opportunities. By breaking down revenue by client, practice area, or attorney, firms can identify where their competitive strengths lie. This data-driven clarity allows managers to double down on profitable niches, pursue targeted marketing, and invest in talent or technology that supports those areas.

Equally important, financial reports reveal cost structures. A firm that knows its true cost per matter, client, or per hour is better positioned to price services competitively without sacrificing profitability. This kind of insight can help a law firm decide whether to expand into new practice areas, open additional offices, or invest in emerging legal technologies such as AI-assisted research. Without precise data, these decisions become speculative and risky. With precise data, decisions are grounded in reality, increasing the likelihood of success.

Enhancing Cash Flow Management

Cash flow is the lifeblood of business, and law firms are no different. Even firms with strong revenue can run into trouble if collections lag, or expenses outpace income. Detailed reporting on accounts receivable, billing cycles, and outstanding client payments enables law firm management to anticipate and mitigate future cash flow challenges.

For instance, reports may show that certain clients or practice areas consistently delay payment. Armed with this knowledge, law firms can tighten billing policies, introduce retainers, or adjust credit terms to protect financial stability. Precise forecasting also helps firms ensure they have sufficient liquidity to cover payroll, overhead, and planned investments, avoiding reactive decision-making during lean periods.

Staffing is one of the largest expenses for law firms. Precise financial reporting provides the clarity needed to match resources with demand. By analysing profitability per attorney, matter, or client, firms can identify underutilised staff, better balance workloads, and make informed decisions about hiring, training, or restructuring teams.

This level of insight also allows firms to reward high performers appropriately, aligning compensation with contribution. In turn, this strengthens retention and motivates teams to deliver high-value work.

Supporting Long-Term Strategy

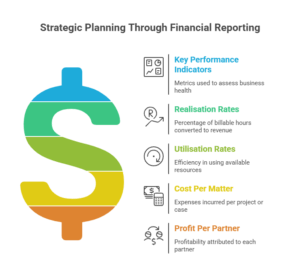

Perhaps the most important role of financial reporting is its impact on long-term strategic planning (see Figure 1). Firms that consistently monitor key performance indicators (KPIs) such as realisation rates, utilisation rates, cost per matter, and profit per partner gain a forward-looking perspective on their business health.

(Figure 1)

With accurate data, leaders can set realistic growth targets, forecast future revenue, and evaluate the potential impact of market shifts. For example, if reporting reveals a steady increase in demand for compliance-related services, the firm might choose to build a dedicated practice group, positioning itself ahead of competitors.

Financial reporting also provides a foundation for scenario planning. Leaders can model the financial impact of expanding into new markets, adopting new technologies, or adjusting billing structures. By testing scenarios with real data, Australian law firms reduce risk, and improve their resilience against industry changes.

Building Client Trust and Transparency

Clients are increasingly demanding transparency and value from their legal providers. Precise financial reporting supports this expectation by allowing firms to provide clear, defensible billing. When a firm can demonstrate how fees align with the value delivered, it enhances trust, and strengthens client relationships.

Some firms are even using reporting capabilities as a differentiator, offering clients customised reports that show progress, costs, and outcomes. This not only reinforces credibility, but also positions the firm as a strategic partner rather than just a service provider.

Financial reporting is more than numbers on a page; it is a strategic asset that drives profitability, improves cash flow, supports resource allocation, and builds long-term resilience. For Australian law firms navigating an increasingly complex and competitive environment, accurate reporting provides the clarity and confidence needed to make sound decisions. Legal firms that embrace financial reporting as a strategic tool will not only improve their current performance but also secure a stronger, more sustainable future.

For further information on how Boutique Ledgers can assist with your financial management, click here.

References

legalcompass.com.au (2024). Financial Management for Law Firms: Budgeting and Forecasting Best Practices. [online] Legal Compass: Client Acquisition & Marketing Solutions for Law Firms | Compliance Resources & Forms. Available at: https://legalcompass.com.au/financial-management-for-law-firms-budgeting-and-forecasting-best-practices/