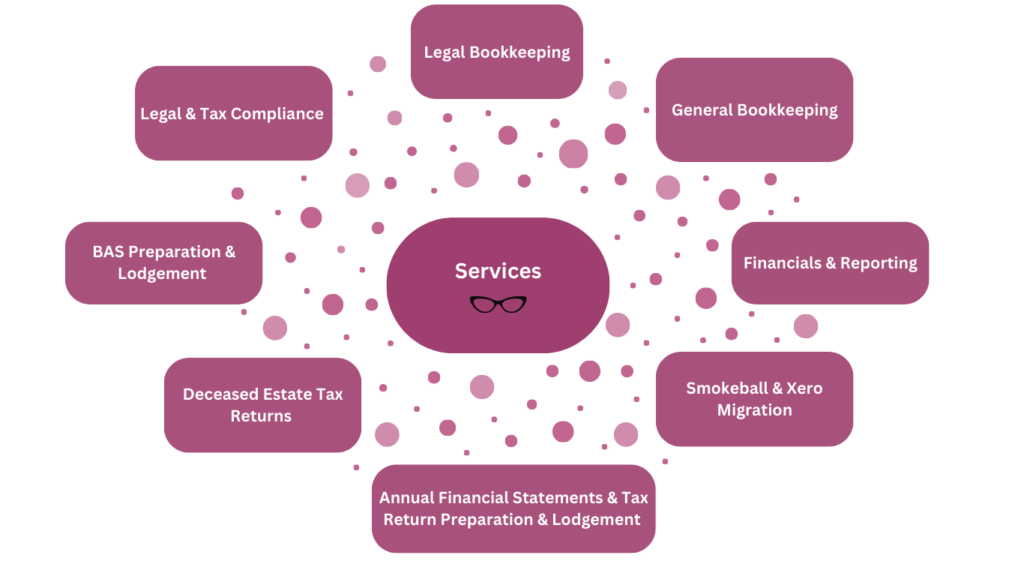

At Boutique Ledgers, we provide comprehensive accounting and trust management services tailored specifically for Australian law firms. With decades of experience in bookkeeping, accounting, and law firm compliance, our team ensures your practice stays organised, audit-ready, and fully compliant with all regulatory requirements. Whether you need a single service or a comprehensive solution, you can have peace of mind knowing you’ve chosen the right team for the job.

Trust Account Management

Boutique Ledgers specialises in law firm trust account compliance in Australia, managing client funds with precision and integrity. We ensure every transaction is correctly recorded, reconciled, and compliant with Australian legal and regulatory standards. From daily trust account management to audit preparation, our services protect your law firm, clients, and reputation, providing confidence that your trust accounts are always accurate and fully compliant.

Legal & Tax Compliance

We offer expert law firm compliance services, helping your firm navigate complex regulatory requirements with ease. Our team ensures your operations adhere to the highest standards, from trust accounting regulations to industry best practices. With Boutique Ledgers as your compliance partner, you can focus on your client’s results, while we manage the details that keep your firm audit-ready and fully compliant.

General Bookkeeping

Our general legal bookkeeping services are designed to keep your law firm’s financial records accurate, up-to-date, and fully reconciled. We handle everything from accounts payable and receivable to expense tracking and transaction management, ensuring your books are always ready for a review or audit. With meticulous attention to detail, we help reduce errors, save time, and support informed business decisions.

Financial Reporting

Our law firm financial reporting services provide clear, accurate, and actionable insights into your firm’s financial health. We prepare reports that highlight performance, track profitability, and support strategic decision-making. Whether you need monthly, quarterly, or annual reporting, our team ensures your numbers are reliable, comprehensive, and easy to interpret.

BAS Preparation & Lodgement

We handle BAS preparation & lodgement for Australian law firms, ensuring business activity statements are accurate, compliant, and submitted on time. By managing GST, PAYG, and other regulatory obligations, we help reduce compliance risk, and free you from the stress of complex taxation requirements.

Annual Financial Statements & Tax Return Preparation and Lodgement

Boutique Ledgers prepares and lodges complete annual financial statements and tax returns, which are tailored for law firms. Our team ensures that your financial statements accurately reflect your firm’s performance, while meeting all regulatory and ATO requirements. By combining precision, compliance, and strategic insight, we provide peace of mind, and help your firm plan for future growth.

Deceased Estate Tax Returns

We provide specialist tax services for deceased estates, helping executors and beneficiaries manage their obligations with clarity and care. From preparing the final tax return to lodging estate tax returns and handling capital gains on inherited assets, we ensure everything is compliant with ATO requirements.

Xero & Smokeball Migration

We assist with the seamless migration to Xero and Smokeball, ensuring your financial and practice management systems are set up for efficiency from day one. Our process covers data transfer, system integration, and customised setup so your firm can confidently manage accounts, billing, and matter workflows.